Screenshots

Description

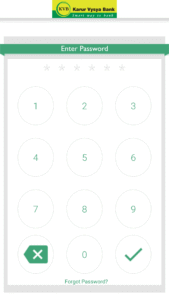

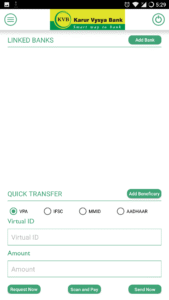

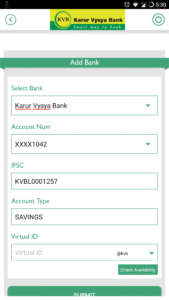

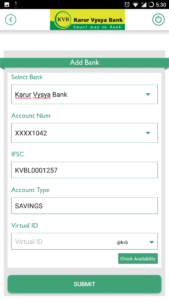

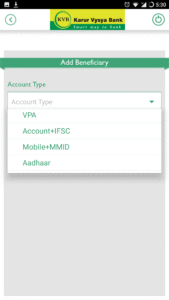

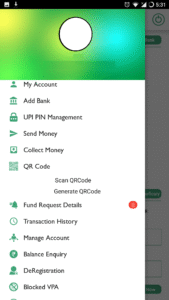

Karur Vysya Bank presents KVB Upay – A Unified Payments Interface (UPI) application that lets you transfer funds from any bank account using a Virtual Payment Address (VPA), IFSC & Aadhaar. What is UPI? Unified Payments Interface (UPI) is an instant real-time payment system developed by National Payments Corporation of India facilitating inter-bank transactions. The UPI is regulated by the Reserve Bank of India (RBI) and works instantly by transferring funds between two bank accounts on a mobile platform. If you operate multiple banks account & use multiple apps for your payments? Switch to KVB Upay for managing all your accounts at one place. Benefits of using KVB Upay - No need to remember account number, IFSC for fund transfer - Send/Collect money using a Virtual Payment Address - Access all bank accounts linked to your mobile number in one app - Pay to friends & relatives using their VPA - Pay to any user using any UPI application. - Request money from any UPI user - Scan a QR and pay on the fly. - Make Payments by QR Scanning - Check account balance - Block unwanted VPA as Spam What are the requirements for using KVB UPay? You should have following - A Smartphone phone with internet services - An operative bank account - The mobile number being registered with UPI must be linked to the bank account. - Active debit card relating to this account for creating mPin. How to register for KVB Upay? - Download “BHIM KVBUPay” from iOS App Store - Click on “Proceed” to verify your mobile number. - An SMS will be sent from your mobile for verification. In case of Dual SIM, Users need to select the SIM registered with the bank for verification. - After your mobile number is verified, the Profile Registration screen is displayed. Fill in the required details. - Create six digits numeric application password for logging in to application and confirm the same. - Once successfully registered, login to the app and create VPA for the bank account linked. - Select the Bank & create VPA for the bank. - Set mPin for the selected bank using debit card Support 24 X 7: Email id: customersupport@kvbmail.com Toll Free Number: 18602001916 Supported Banks: Visit our website www.npci.org.in/bhim-live-members to find out if your bank is live on BHIM Permissions for App and reasons SMS - As per NPCI guidelines, we will be sending a background SMS to verify the customer and mobile number linked to it. Location – As per NPCI guidelines, we will capture location details Storage – We need this permission to store the scanned QR Code. Calls – We need this permission to detect single/dual SIM and allow user to choose Go ahead and download BHIM KVBUPay application to experience the unique way of making payments using a Virtual Payment Address (VPA).